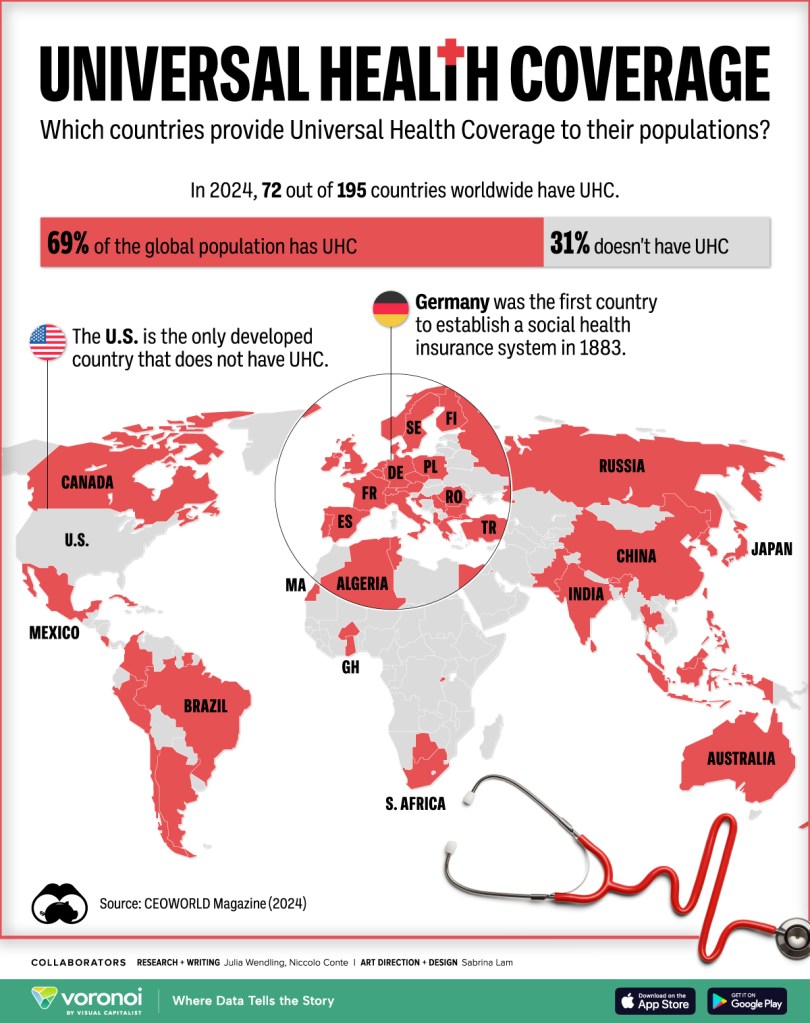

I am a big proponent of universal, single payer healthcare. I strongly believe that healthcare should never be a for-profit business; it is a human service and a human right. America is the only developed nation without a national health system, and we have created a disaster of our health care, a system that serves capitalism and betrays patients.

One of the reasons we wanted to relocate to Europe, while still young enough to enjoy it, is to retire early and bridge the gap between American employer-provided insurance and Medicare with more reasonably priced insurance and/or health care from another country with either national health service, a strong private health care system, or other system.

As a note, I’m feeling more skeptical about Medicare as time goes by, as it is more and more commonly framed by our leadership as an entitlement and a drain, and profitability measures like AI-driven preauthorization review and claims adjustment and denial are being added to the system.

Insurance Options

As I put together my giant spreadsheet of all the options, access to public and private health care service was a primary item I tracked.

Interesting findings:

- Not all countries with national health service are accessible to expats (and nor should they be – citizens have been paying into the system for a lifetime).

- Many countries have combinations of public health and private health care, with the latter generally being a separate system accessed only via specific insurance groups.

- Not all national health service offerings have good reputations, and some vary around the country and in urban vs. rural locations.

- Some countries have insurance-based for-profit health care systems. (Croatia, Montenegro)

- Some countries have less typical systems, like private buy-in insurance pools with their own private medical facilities. (Uruguay)

We looked at Ireland and Germany first. Neither country permits retirees to access their public health system. While both countries have separate private health care systems and insurance, Ireland’s private health has a 5-year pre-existing condition exclusion and Germany’s private health just doesn’t cover pre-existing conditions.

Italy, France, Spain, Portugal, and Greece do all allow all permanent residents to access their public health system after a period of time to establish permanent residency, and all are relatively well-rated. Others are too – but we were focused on these countries because of a combination of ease of retirement visa, good cost of living, health care, and climate.

France’s National Health Care System

The French public health system is called PUMa (Protection Universale Maladie), also called Social Security (covering not only health care costs, but also medical leave, disability, and death insurance). All legal permanent residents have access to this system. Long term visitor visa holders are considered permanent after 3 months of continuous residence. It can take several months from time of application to get set up in the system, but coverage is retroactive. This is a good overview of the system.

PUMa is paid for as part of taxes by those earning income in France, and expats with passive income are required to pay an annual 6.5% of their worldwide earnings (above a threshold of 23,350€) as a social access fee. There is an exception for pensioners, who are receiving a pension or social security, and they do not have to pay this fee.

The public health Carte Vitale (health card) covers 70-80% of the cost of medical care, procedures, and medications. As a note, the full out-of-pocket cost is much lower than American health care – a GP visit is 25-30€, and a specialist visit is 25-80€, depending on sector and location. One of my prescriptions (a blood thinner) is $630/mo out of pocket in the US, and 60€ out of pocket in France. Public health also covers dental and vision.

An additional note is that for those with a long-duration health problem (Affection Long Duree), all items related to that diagnosis are covered at 100%, which is amazing from an American point of view.

Many French health system users purchase private insurance in addition to National Health, called a Mutuelle. Private insurance is NOT a separate system with separate facilities, but instead a top up program that covers remaining costs after National Health coverage.

What about quality and accessibility of health care? On average, it takes 6-10 days to get in to see a GP, and 3-7 weeks for an appointment with a specialist, with timing varying by specialty and region. That is not significantly different than American health care wait times. By all accounts, the French medical system scores better than the American system for quality of care and desirable outcomes. I found some interesting general rankings of health care systems, and this 2023 meta-analysis is from Statista.

Public Health Cost Share for Expats

There has been some press lately about the French proposing and passing legislation to require that retired American expats pay for the system and no longer use it for free. This is sensationalist and not entirely true nor complete.

It applies to all expats, not just Americans, and it applies consistent thresholds, criteria, and caps for contributing to the system. This is a good article summarizing the issue.

Visa-Required Private Insurance

A French long stay visa requires, among other criteria, that each individual purchase private insurance for the duration of their requested visa. In summary, the policy should:

- Should be an international Private Health Insurance Policy, NOT a travel insurance policy.

- Should cover both medical expenses and hospitalization.

- Should have a minimum medical coverage of €30,000

- Should not mention any medical exclusions (pre-existing conditions must be covered by your medical policy)

- Should cover repatriation.

There seem to be two different types of medical insurance marketed for visa support.

Gold standard insurance, which covers all the above and more, including pre-existing conditions, often to a much greater € threshold. It often requires a medical questionnaire and underwriting review and may assign surcharges based upon perceived risk.

Basic visa insurance, which covers the minimum of the above and not more. It’s fast and inexpensive, only covers major medical, and explicitly mentions no medical exclusions (nor does it include them, and for some reason, this is ok w/ the consulate.)

Note that I’ve seen reports that it is difficult to obtain new private insurance for visa purposes at ages greater than 70 or 75 years old. If you are on an existing policy and pass that age threshold, though, your insurance continues.

There are many insurance brokers who post on the various “Moving to France” social media groups who can assist with recommendations for companies and policies.

Visa Insurance Cost Comparison

I’m going to share specific costs to insure both of us for general benchmarking purposes, however, everyone’s situation varies and cost quotes are personal based on age, duration, health questionnaire, amount of coverage, etc.

Gold standard insurance: 414€/mo, no deductible, 90% coverage, pre-existing coverage, 100,000€ per person cap (worldwide coverage)

Basic visa insurance: 144€/mo, 50€ per claim deductible, 35,000€ per person cap (Schengen area coverage)

At the same time we were quoting and buying visa insurance, we signed up for COBRA from my husband’s recent employer for American coverage, and also priced coverage on the state exchange, for the two of us.

COBRA coverage: $2,125/mo for both of us, with a $1,500 deductible and 20-30% copays (US-only coverage)

State exchange quotes: $2,346/mo to $3,574/mo for both of us – all had $2,000-4,000 deductible and 20-30% copay, all of them excluded couple of my cardiac meds, and none covered both of my frequent doctors on one plan (US-only coverage)

Personal Fear

One of my biggest fears is that either Kit or I end up with an expensive major medical crisis that bankrupts both of us and leaves the survivor destitute. Medical bankruptcy with an impoverished surviving spouse happen a lot in America! That scenario does NOT happen in countries with national health service, and in fact, the French don’t comprehend the term “pre-existing condition”.

This relocation overseas makes a LOT of sense from a health care quality and cost perspective, and I’m glad we’re embarking upon the adventure.